UNITED PARCEL SERVICE (UPS)·Q4 2025 Earnings Summary

UPS Beats on EPS and Revenue, Guides to 2026 Inflection Point

January 27, 2026 · by Fintool AI Agent

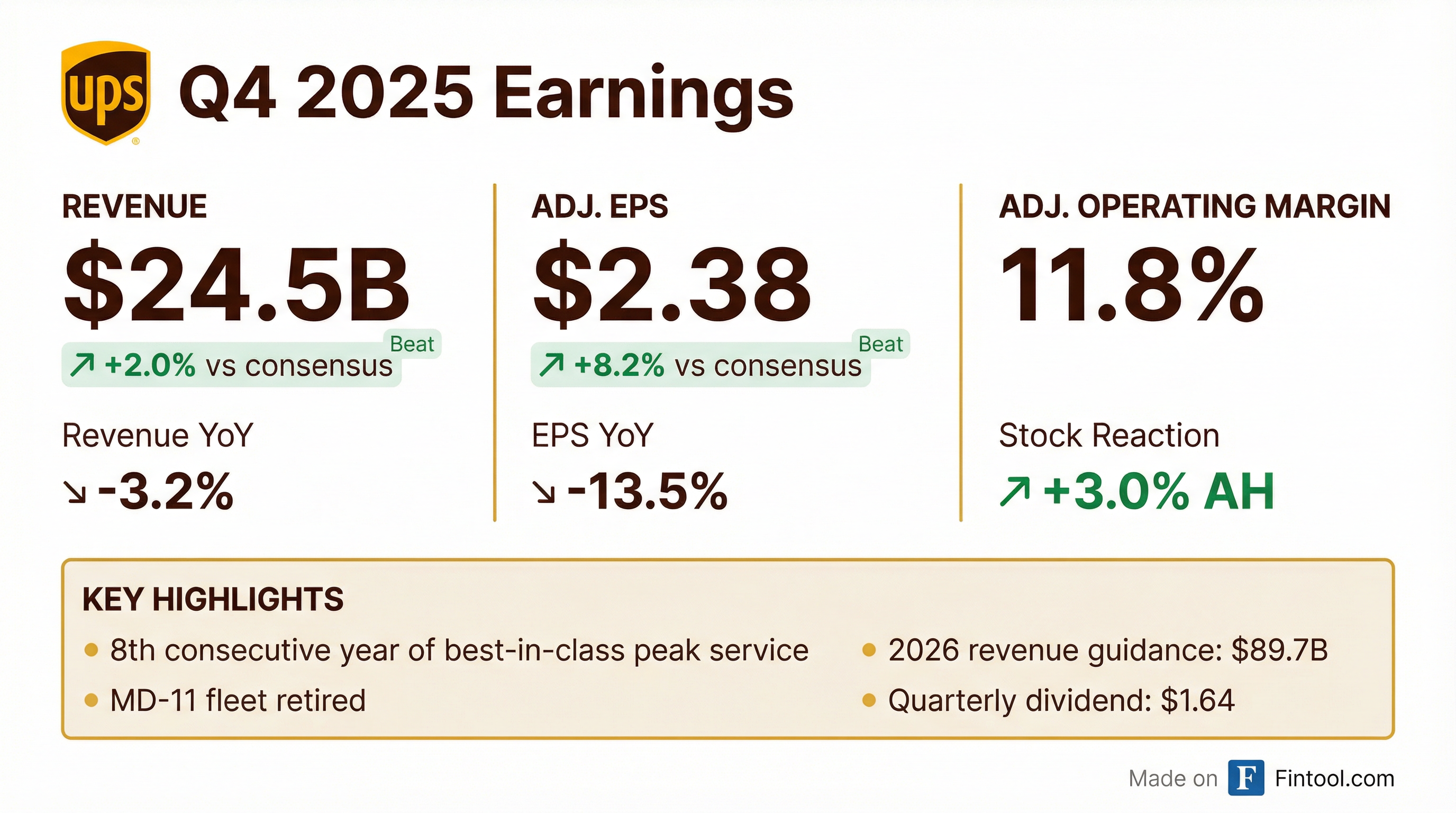

United Parcel Service delivered better-than-expected Q4 2025 results, beating consensus on both revenue and earnings while marking its eighth consecutive year of industry-leading on-time service during peak. The company reported revenue of $24.5 billion and adjusted EPS of $2.38, outpacing Street expectations of $24.0 billion and $2.20, respectively.

CEO Carol Tomé began the call by remembering those lost in the tragic crash of UPS Flight 2976, praising the Worldport team's response and thanking the Louisville community for their support.

Shares rose approximately 3% in after-hours trading to $110.20, reflecting investor optimism around management's characterization of 2026 as an "inflection point" following completion of the Amazon volume reduction.

Did UPS Beat Earnings?

Yes. UPS beat on both the top and bottom lines:

GAAP results included $238 million in charges ($0.28 per diluted share), comprising a $137 million after-tax write-off for the retired MD-11 aircraft fleet and $101 million in transformation charges.

This marks UPS's seventh EPS beat in the last eight quarters, continuing a strong track record of managing through the Amazon transition while exceeding expectations.

How Did Each Segment Perform?

U.S. Domestic Package (68% of revenue)

Revenue per piece breakdown (8.3% growth):

- Base rates and package characteristics: +340 bps

- Customer and product mix: +320 bps

- Fuel: +170 bps

Mix improvements: SMB penetration reached 31.2% (highest Q4 ever, +340 bps YoY), B2B penetration hit 37.5% (highest Q4 in 6 years, +220 bps YoY).

International Package (21% of revenue)

International was the only segment to grow revenue YoY, driven by revenue quality efforts in all regions. However, margin compression of 360 bps reflects trade lane mix shifts from tariff and de minimis policy changes:

- U.S. imports down 24.4% overall

- Canada/Mexico lanes down 30.5%

- China to U.S. down 20.9%

More than half of the operating profit decline was related to trade policy changes shifting volume away from higher-margin U.S. import lanes.

Supply Chain Solutions (11% of revenue)

Revenue declined primarily due to lower air/ocean forwarding rates and Mail Innovations volume, but margin expanded 100 bps as efficiency initiatives took hold. UPS Digital (Roadie and Happy Returns) grew revenue 27% YoY, a bright spot in the segment.

What Did Management Guide for 2026?

CEO Carol Tomé framed 2026 as a pivotal year:

"2025 was a year of considerable progress for UPS as we took action to strengthen our revenue quality and build a more agile network. Looking ahead, upon completion of the Amazon glide-down, 2026 will be an inflection point in the execution of our strategy to deliver growth and sustained margin expansion."

2026 Cost-Out Targets

Context: 2025 full-year adjusted operating margin was 9.8%, so 2026 guidance implies modest margin compression as the company works through the final stages of the Amazon transition. However, management expects the network restructuring to unlock sustained margin expansion beyond 2026, exiting at "a healthy double-digit margin" by year-end.

What Did Management Say About the Shape of 2026?

CFO Brian Dykes described 2026 as having a "bathtub effect" — first half down, second half up:

"The way I think about the year is like a bathtub effect. The halves will look different. First half down, second half up, but for the year, the U.S. revenue and operating margin will be flat, and we will exit 2026 with a leaner, more agile U.S. network, one that's built for growth and sustained margin expansion."

First Half Headwinds

Second Half Recovery

Management expects high single-digit operating profit growth in H2 2026, driven by:

- Amazon glide-down completion

- GroundSaver USPS transition benefits materializing

- Driver staffing aligned with new delivery volumes

- Automated network running at full efficiency

What Changed From Last Quarter?

Network Transformation Progress

UPS achieved significant milestones in its multi-year transformation:

- Workforce reduction: ~48,000 operational positions eliminated in 2025, including 15,000 fewer seasonal workers

- Facility closures: 93 buildings closed in 2025 (vs. 73 originally targeted)

- Cost savings: $3.5 billion saved in 2025; targeting ~$3 billion additional in 2026

- MD-11 retirement: Fleet modernization accelerated with complete retirement in Q4

Full Year 2025 Results

Despite a 2.6% revenue decline, UPS held adjusted operating margin flat at 9.8% while returning $6.4 billion to shareholders through dividends and share repurchases.

How Did the Stock React?

UPS shares rose ~3% in after-hours trading following the earnings release:

The positive reaction reflects:

- Earnings beat on both revenue and EPS

- Better-than-expected margins despite volume headwinds

- Management's confident tone about 2026 inflection

- Continued strong capital returns ($1.64/share quarterly dividend maintained)

Key Highlights From the Quarter

Pricing Power Remains Strong

Revenue per piece growth significantly outpaced volume declines across all segments:

Capital Allocation Priorities

UPS maintained its shareholder-friendly capital allocation:

- Dividend: $1.64 per share quarterly dividend declared, payable March 5, 2026

- Buybacks: $1.0B share repurchases completed in 2025

- CapEx: $3.7B invested in 2025; guiding to $3.0B in 2026

Balance Sheet Position

What's Priced In Now?

Pre-earnings sentiment: Analysts were divided heading into the report, with concerns about continued volume pressure from the Amazon glide-down and macro uncertainty around tariffs and trade policy. The stock had declined 19% over the prior year.

Post-earnings shift: The beat and management's confident framing of 2026 as an "inflection point" appear to have addressed some investor concerns about the path to margin recovery. Key questions that remain:

- Amazon execution: What is the remaining Amazon volume and how quickly will costs align?

- Macro risks: Tariff uncertainty and potential trade disruptions

- Margin trajectory: Can the $3B in 2026 savings offset the remaining transition headwinds?

Q&A Highlights: What Analysts Asked

On Post-Glide-Down Algorithm (UBS - Tom Wadewitz)

When asked about the go-forward algorithm post-Amazon, CFO Brian Dykes outlined:

- Revenue growth: Mid-single digit enterprise and SMB volume growth in back half

- Pricing: ~3% base rate increases expected, down from current elevated mix-adjusted levels

- Margins: Cost per piece to normalize below revenue per piece, driving structural improvement

On the GroundSaver/USPS costs (~$400-500M headwind in 2025), CEO Carol Tomé noted full benefit recovery won't occur until 2027. Notably, UPS secured access to USPS Destination Delivery Units (DDUs) in the new agreement—an opportunity that wasn't available a year ago and will help ensure service levels remain high.

On Cost Per Piece Normalization (Citi - Ari Rosa)

Executive VP Nando provided key automation economics:

"The cost per piece in these automated buildings is 28% less than the cost per piece in our conventional buildings."

UPS has 127 automated buildings today and is adding 24 more in 2026.

On International Pressures (Wells Fargo - Chris Wetherbee)

Kate Gutmann on international margin compression:

- U.S. inbound lanes (down 24.4% YoY) carry 20-30% margins

- Replacement growth lanes carry mid-teens margins

- Asia diversification investments (Vietnam hub 80% full) are paying off

- Volume normalized in May (tariffs), margins normalize in September (de minimis)

On Long-Term Outlook (Morgan Stanley - Ravi Shanker)

When pressed on long-term earnings trajectory, Carol Tomé acknowledged significant changes since the 2024 Investor Day:

"Let us get through this year. 2026 is the pivotal year for UPS, and once we get through this year, we'll come back out and give our view on that."

On Labor Contract Implications (Susquehanna - Bascome Majors)

On managing the 2023 Teamsters contract cost step-up in late 2026:

- Network of the Future automation is ahead of schedule

- 40,000+ positions already eliminated

- Labor-intensive network being replaced with flexible, scalable automation

- Total expense declining despite contractual wage increases

Strategic Initiatives Making Progress

New Infrastructure Investments

- Philippines air hub: Opening late 2026

- Hong Kong expansion: On track for 2028

- Boeing 767 fleet: 18 new aircraft (15 in 2026, 3 in 2027) replacing MD-11s